How to Attract Investors: Strategies for Business Success

Attracting investors is a crucial part of building and expanding a successful business. Whether you're a startup looking for seed funding or an established company aiming for growth capital, understanding how to appeal to potential investors is vital. In this comprehensive guide, we will delve into strategies and best practices that not only help you understand how to attract investors but also position your business as an attractive opportunity for investment.

Understanding Your Value Proposition

Before you even consider reaching out to potential investors, it's imperative to have a clear understanding of your business's value proposition. A value proposition is essentially what makes your business unique and why it deserves investment. Here are key points to consider:

- Identify Your Unique Selling Points (USPs): What does your business offer that competitors do not? Is it a unique product, superior customer service, or innovative technology?

- Articulate Your Market Position: Show how your business fits within the larger market. Are you a leader in your niche or are you aiming for a specific target audience?

- Demonstrate Market Demand: Provide evidence that there is a demand for your product or service. This can be done through market research, customer testimonials, or sales trends.

Building a Solid Business Plan

A well-structured business plan is essential when seeking to attract investors. Your business plan should provide a detailed road map of your business and outline how you plan to generate revenue. Components to include are:

1. Executive Summary

This is a brief overview of your entire business plan and should capture the essence of your business idea. It needs to be concise, engaging, and understandable.

2. Company Description

Describe your business model, the mission statement, and the structure (e.g., LLC, corporation) of your business.

3. Market Analysis

Conduct thorough research into your industry, market size, expected growth, and competitive landscape. Highlight trends and insights that support your business's viability.

4. Organization and Management

Introduce your team, detailing their roles and relevant experience. Investors want to know the expertise behind the business.

5. Service or Product Line

Describe your offerings in detail, highlighting their lifecycle, intellectual property, and benefits over competitors.

6. Marketing and Sales Strategy

Outline how you plan to attract and retain customers. Specify your marketing channels, sales tactics, and forecasted sales growth.

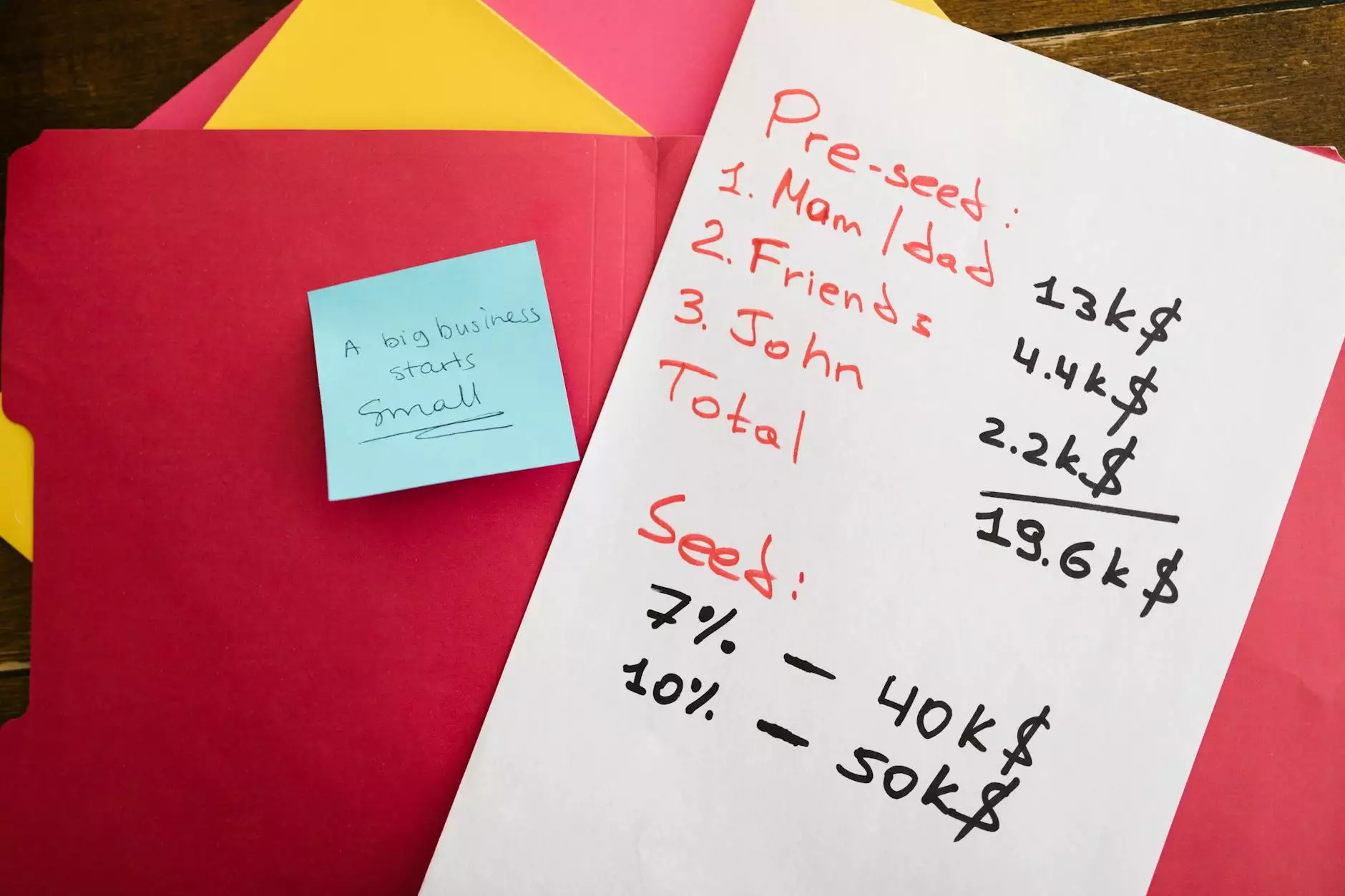

7. Funding Request

Clearly state how much funding you need and how you plan to use it. Be specific about the allocation of funds.

8. Financial Projections

Provide projected income statements, cash flow forecasts, and balance sheets for at least three years. This gives investors a clear picture of your expected financial health.

Developing an Effective Pitch

Once your business plan is in place, the next challenge is creating a compelling pitch for potential investors. Here are some tips for developing an effective pitch:

- Practice Makes Perfect: Rehearse your pitch multiple times to ensure you are confident and clear.

- Know Your Audience: Tailor your presentation to the interests and backgrounds of your investors.

- Use Visuals Wisely: Incorporate engaging visuals, such as graphs and charts, to support your claims and keep your audience interested.

- Be Honest and Transparent: Don’t sugarcoat potential risks or challenges. Honest discussions build trust.

- Feedback and Adaptation: Be open to feedback and willing to adapt your pitch based on investor responses.

Networking: Building Relationships

Successful investing often hinges not just on financials but on relationships. Building a network of potential investors is crucial. Here’s how you can effectively network:

1. Attend Industry Events

Get involved in trade shows, conferences, and seminars related to your industry. These events are perfect opportunities to meet potential investors in a casual atmosphere.

2. Utilize Social Media Platforms

Platforms like LinkedIn are invaluable for networking. Share your insights, connect with industry leaders, and engage with groups relevant to your business niche.

3. Join Investment Groups

Seek out local or online investment clubs. These groups are often a mixture of investors and entrepreneurs, providing mutual opportunities for collaboration.

4. Build Relationships with Financial Advisors

Your financial advisor can introduce you to potential investors. Collaborate with them to create opportunities for exposure.

Leveraging Online Platforms

In today's digital age, leveraging online platforms to attract investors is an excellent approach. Here are some effective methods:

- Crowdfunding Platforms: Websites like Kickstarter, Indiegogo, and SeedInvest allow you to present your business proposal to a broad audience of potential investors.

- Angel Investor Networks: Engage with platforms that connect startups with angel investors, such as AngelList or Gust.

- Online Pitch Competitions: Participating in online competitions can provide exposure and sometimes direct investment.

Creating a Strong Online Presence

In addition to networking, establishing a strong online identity is significant in attracting investors. Here’s how to do that:

1. Website Development

Invest in a professional, user-friendly website that details your business's mission, services, and contact information. Make sure it’s optimized for search engines to increase visibility.

2. Content Marketing

Produce valuable content related to your industry. Blog posts, webinars, and newsletters can establish you as an authority in your field and attract attention from potential investors.

3. Public Relations

Engage with PR specialists to disseminate press releases and news articles that highlight milestones, funding achievements, or innovative breakthroughs. A good story can catch the eye of investors.

Utilizing Professional Advisors

Sometimes, assistance from specialists can enhance the chances of attracting investment. Here’s how:

- Financial Advisors: They can help fine-tune your financial projections, making them more appealing to investors.

- Business Consultants: Their insights and expertise can guide you in strengthening your strategy, making your pitch more appealing.

- Legal Experts: Ensuring that all legal documentation and compliance issues are handled appropriately can prevent potential roadblocks in the investment process.

Building a Track Record

Investors want to see a strong track record of success. Whether you're a startup or an established business, having substantial metrics and milestones helps to build credibility.

- Sales Growth: Document consistent sales growth over time. Investors want assurance that your business is on an upward trajectory.

- Customer Retention: A high customer retention rate indicates satisfaction and can convince investors of your product's value.

- Profit Margins: Showcase improving profit margins to communicate financial health.

Concluding Thoughts: The Future of Your Business

Attracting investors is a multifaceted process that requires diligence, preparation, and adaptability. By understanding your value proposition, building a solid business plan, developing an effective pitch, and leveraging modern tools and networks, you will significantly increase your ability to attract investment. Remember, the goal is to demonstrate not just the stability of your business but its potential for growth in an evolving market landscape.

Ultimately, attracting investors is about building valuable relationships and showcasing your business's unique ability to meet market demands. Stay informed, continue to hone your skills, and, most importantly, believe in the value of your enterprise.